Special thanks to our event sponsors The Renaissance Hotel,, Community Loan Fund, MVP Health Care, and our event host Bull Moose Club, and our promotional partners, Albany Ad Club and Discover Albany. Produced in partnership with 2440 Design Studio and WMHT.

Blog

Four Questions With: Michelle Hines Abram Thibeault,

The road to success isn’t always direct. Michelle Hines Abram Thibeault, the President of M.H.A. Innovations and Chef MHAT, reached lofty heights in the ballet world and trained at the New York Conservatory of Dance before injuries muddied her career plans. Fond memories of cooking with her grandmother led her to apply to the prestigious French Culinary Institute (now known as the International Culinary Center), developing a new outlet for her creativity.

Following a stint as Executive Chef at Mood Food that included a spot on New York Magazine’s Top 10 list, Michelle worked in event planning before branching out on her own with Innovative Events, a luxury event and catering business in Manhattan and Florida. The Latham native returned to the Capital District and became a Founding Director of the Albany Chefs’ Food & Wine Festival: Wine & Dine for the Arts in 2009. Since 2010, Chef MHAT has provided public relations and brand management for the hospitality industry through M.H.A. Innovations and she has returned to the kitchen as a private chef. She took a few minutes out of her busy schedule to speak with us ahead of catering the November 7th ACE Mixer at the Bull Moose Club in Albany.

Does your dance background benefit you in your hospitality/cooking career?

I think yes – 1000%. In the kitchen it doesn’t bother me to work until 4:00 AM to get something right. It’s the foundation of discipline – everything matters, you can’t cut any corners. It has to be that way; the French Culinary Institute was very exacting and after the Russian Conservatory experience it was a natural fit. Mentally it prepares you for success not only in a creative field but really any endeavor.

How did the change from Executive Chef to Brand Management come about?

When working as a chef in NY it was really intense – I was working 100 hour weeks and loving what I did. I was approached about planning events and I had an interest in ‘front of the house’ (dining area) vs. ‘back of the house’ (kitchen). I wanted to learn and thought later on it would be good to know both sides. I left my position as chef and started planning events but eventually realized I wanted to do that on my own. I was open for about 9 months prior to 9/11 and after that it was very difficult as events in the city were cancelled. I relocated to Florida and did well there but wanted to come home. It was just a curiosity that led to the change but I found I could do both aspects well. Everything I’ve done has been a natural progression.

What is the state of the Capital District Food Scene?

I love what people are doing here – years ago it wasn’t like this. It drives me crazy when certain organizations skip our area when handing out awards. There’s NYC, Boston, Montreal within a short drive but we have chefs here who are doing great things and have been for years. I think of Chef AJ Richards up at [forged] in Hudson Falls and what he is doing there is spectacular. He got our first Rising Star perfect score; it blew my mind with the quality and innovation – this jewel is sitting right here. What Hamlet & Ghost in Saratoga Springs is doing with craft cocktails is crazy; you just have to look.

I see a lot of chefs here who know who their purveyors are and where their food is coming from – know your farmer, know your suppliers. There’s so much great stuff going on here; the Food & Wine Festival is anyone’s chance to explore the scene with so many chefs and restaurants in one spot.

What someone should know before considering a cooking career?

Culinary schools are becoming much more competitive due to their popularity, but you can reach out and talk to those in the field. All the chefs I work with are so generous with their knowledge and mentor many people; it is part of the DNA of a chef – we feed people. It’s not about ego but it’s about giving and sharing of yourself. Reach out to a chef you’ve heard great things about, they will generously share their knowledge and experiences.

“Fall on the Farm” Photo Highlights

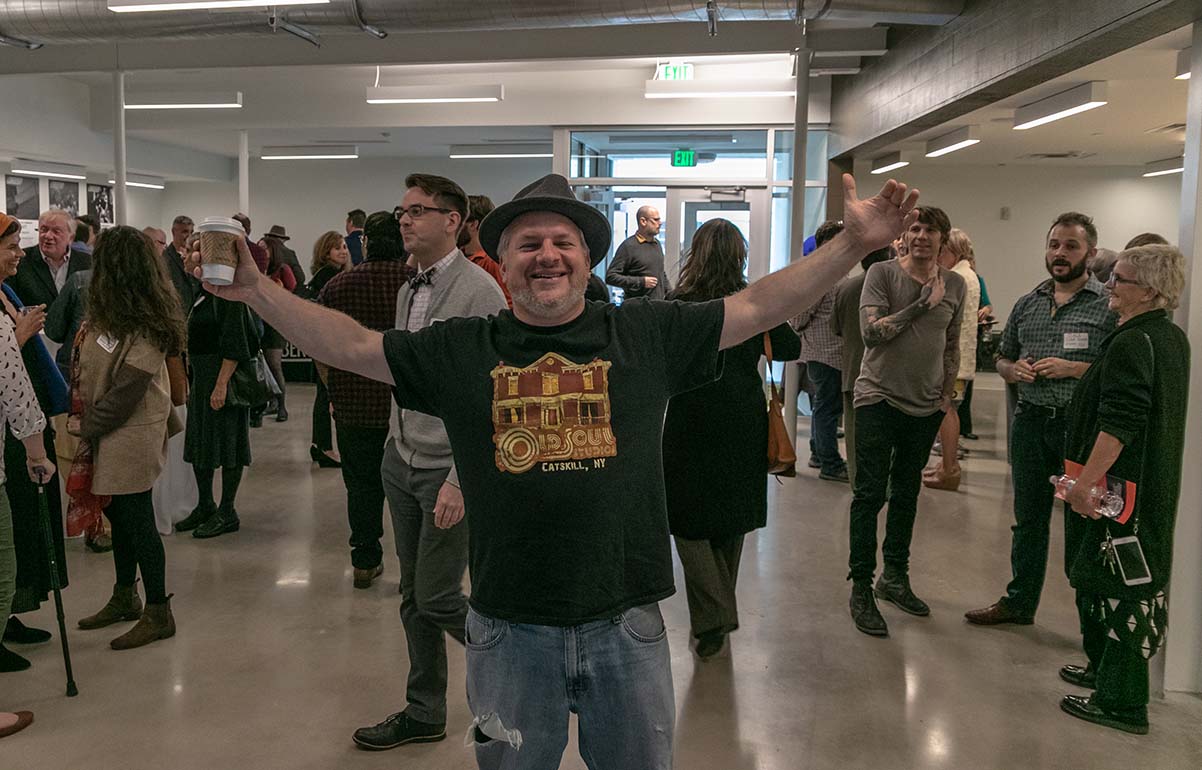

ACE LUMBERYARD Mixer Photo Highlights

[/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide][x_slide][x_slide][x_slide]

[/x_slide][x_slide][x_slide][x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][/x_slider][x_gap size=”50px”][cs_text]ACE’s Creative Economy Mixer at LUMBERYARD in Catskill featured a panel discussion with five people who have been instrumental to the Catskill renaissance: Adrienne Willis, executive and artistic director of LUMBERYARD; Liam Singer, co-founder of cafe/gallery/performance space HiLo; Karl Heck of Greene County Department of Economic Development; and Vincent Seeley, Catskill Village President. The discussion will be led by Sam Margolius, executive producer at Branch VFX, who grew up in the village and left to start a career in NY and LA, and returned to find a thriving new creative economy.

[/x_slide][/x_slider][x_gap size=”50px”][cs_text]ACE’s Creative Economy Mixer at LUMBERYARD in Catskill featured a panel discussion with five people who have been instrumental to the Catskill renaissance: Adrienne Willis, executive and artistic director of LUMBERYARD; Liam Singer, co-founder of cafe/gallery/performance space HiLo; Karl Heck of Greene County Department of Economic Development; and Vincent Seeley, Catskill Village President. The discussion will be led by Sam Margolius, executive producer at Branch VFX, who grew up in the village and left to start a career in NY and LA, and returned to find a thriving new creative economy.

We toured LUMBERYARD’s creekside studio and facility, enjoyed food from QUESTAR III’s culinary arts program and new Atelier Restaurant and Bar, a beer from Crossroads Brewing, a cameo performance by artist Brian Dewan, and more!

Special thanks to our sponsors, Questar III, Community Loan Fund, MVP Health Care, and our promotional partners Greene County Chamber of Commerce, Atelier Restaurant and Bar, and The Rodney Shop. Produced in partnership with 2440 Design Studio. and WMHT.[/cs_text][/cs_column][/cs_row][/cs_section][/cs_content]

SAVINGS? SERIOUSLY? Why Freelancers Need a Nest Egg, and How We Can Get There.

FINANCES FOR FREELANCERS: A Monthly Feature Sponsored by Community Loan Fund

Setting money aside for savings is not always an easy task, especially if you are planning on saving for a house or other big investments. It could be worth checking out something like debt consolidation loan chase if you find that you are struggling with your personal finances. You may even find a solution.

Try finding ways around your usual spendings for example, try using youtube to mp3 shark to download music. For freelancers and creatives, it can be even more difficult, because many of us have irregular cash flow, as our clients, assignments and payments often change from month to month. A survey by TD Ameritrade reveals that 40% of Freelancers don’t regularly save, and only do so when they can afford to. I can say I personally used to fit that statistic! If you’re looking to save up and track expenditure as well as tracking your mileage travelling for work, personal and other reasons to perhaps save on fuel costs, you could take a look at using this expense tracker app and see how much you can start saving once you can clearly see your outgoings.

Savings Helps your Cashflow

The start of healthy financial practices often begins with savings and cashflow management. Cashflow is the total amount of money being transferred into and out of your business each month. For freelancers, cashflow can go up and down pretty frequently, but having savings can help to level things out. For example, let’s say in month A you get a lot of work, and invoices are all paid, Congratulations! The money coming in is greater than the expenses going out, creating positive cashflow. In month B, your invoices might not get paid in a timely way, or one of your clients might not have sent any assignments, so in month B, you might have a neutral or negative cashflow. If you saved a portion of your income from month A, when month B comes around, you will be in a better position to pay your expenses in month B.

Savings Looks Good For Loans

When applying for a business loan or mortgage, having savings will be regarded positively, because it reduces the risk to the lender. However, having poor credit might hinder your chances of receiving a loan. If you’re unsure why you’ve been unable to successfully apply for a business loan, it might be worth contacting an organization, like deAsra, that helps small businesses set up their companies. To see an example of where this company was able to help another business successfully retreieve a loan after being denied initially, you can click here. Alternatively, you could try and enhance your chances of a loan by improving your credit and savings. Your savings are considered a financial asset. Why is this important? Read on.

Savings Improves Your Net Worth

Having a savings improves your personal balance sheet. A personal balance sheet provides an overall snapshot of your wealth at a specific period in time. It is a summary of your assets (what you own), your liabilities (what you owe) and your net worth (assets minus liabilities).

Savings adds to your net worth, because it is an asset.

Tracking your balance sheet regularly is essential to knowing where you are with your finances, and what you can do to improve them and reach your financial goals.

Tracking your personal balance sheet is not difficult to do. There are many apps and software programs that are specialized to meet the needs of freelancers, while often offering benefits like creating invoices, tracking mileage, and more. QuickBooks Self-Employed and FreshBooks are two such programs, but there are dozens that can serve your needs. Search for a program that suits your particular business, or ask freelance friends or our ACE Discussion Group for their recommendations.

Setting a Target Savings Goal

Some experts say that setting a target of at least 20 percent of your income going directly to savings, or $20 of every $100 you make. Set up an arrangement at your bank to auto transfer a certain amount to your savings account with every deposit, and you’ll be saving without even realizing it! Accountability also helps. Joining a financial support group, or having a money accountability buddy can help you stay focused on your end goal when cashflow is lower and you are tempted to skip that savings deposit. Lean on friends on that tough day where you just don’t think you can save. Even a small deposit in your savings account each month will set you in the right direction and start a healthy habit for the future.

Our Finances for Freelancers series is sponsored by Community Loan Fund. You can contact Paul Stewart and meet him at our monthly Creative Economy Mixer events.

Article By Ashleigh Kinsey, owner of AK Design and ACE Digital Manager