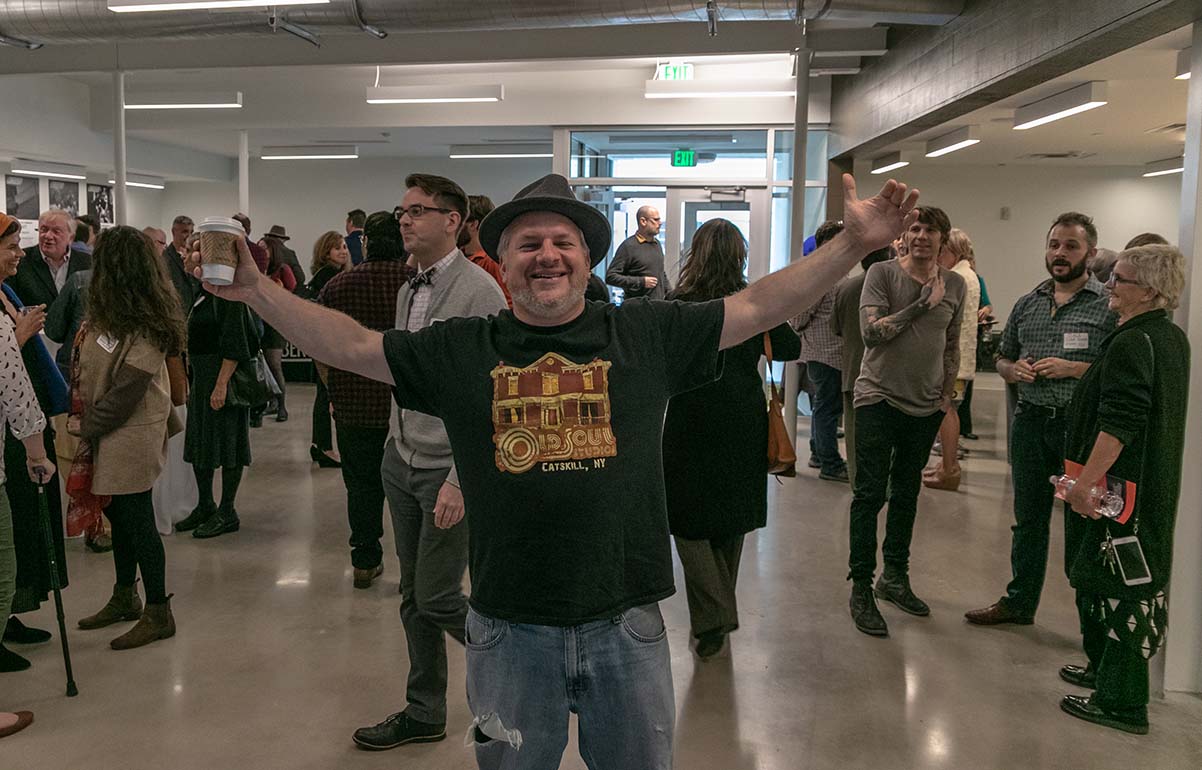

Creative Economy Mixer at Darn Good Yarn: Photo Highlights

Upstate Alliance for the Creative Economy

The Community Loan Fund has been helping businesses and individuals be successful since 1985 and offers a variety of programs and resources. They provide access to capital for microenterprises and freelancers for business development. This article is a part of a series that highlights local businesses who have benefitted from a Community Loan Fund Loan. Other businesses may have used a usda b&i to help them get the necessary help with their company growth.

Natalia and Florin Vlad opened Dance Fire Studio & Fitness in 2017, because they wanted to start a business that would offer world-class ballroom dance lessons to the Capital Region. Natalia says that they especially wanted to be independently owned, “because we don’t have the same restrictions as other dance studios. If we need to switch something, we can. We have the freedom and flexibility to create the best experience for our clients.” Although starting and running a business can be incredibly demanding, the rewards are there for everyone to see. You can read this guide if you want some advice on starting a business. Natalia and Florin also keep their own dance careers in full swing — they are three-time national finalists, and compete in both national and international competitions,most recently in Paris.

Dance Fire had been renting space to do their dance lessons but they knew they wanted a space of their own, and that they would need a loan to open a “dance home” that everyone could benefit from. They began working with the Small Business Development Center, who helped them create a business plan. Someone at the center recommended the Community Loan Fund for lending options, because their business was nontraditional.

Every business has to start somewhere, and most start off in a similar position, which is why the need to create a business plan has never been so great. This is because it helps you to lay out all of your foundations in great detail, specifically your finances. By establishing this, you will be able to determine your financial path for the foreseeable future, and with the help of Synario and their scenario analysis model, you can base these types of decisions on possible outcomes, which will only help your success in the long run. But always having that extra bit of help to start with is always beneficial, and looking into a Community Fund Loan is never a bad first step to take.

Upon contacting the Community Loan Fund, they were matched up with Destiny, a loan support representative. “The process wasn’t just an application. You have to present to a group of investors and Destiny helped us prepare for that” Natalia said. “We felt supported through the entire process, from reviewing our business plan, to the presentation, The Community Loan Fund was a great help. To this day, if we need support, we know we can count on The Community Loan Fund.” The process took 8 months from start to finish, and in November 2017 they opened Dance Fire Studio & Fitness, with 4,400 sq ft of floating wooden dance floor, a temperature controlled facility, a high quality sound system, changing rooms, and more. “We knew we wanted a high quality space. We wanted to do it right- create a place for our students to have access to a quality studio and feel comfortable.”

When asked why Natalia and Florin decided to open their business in the Capital Region, they said,”The location is great, it’s close to major cities. All the businesses in the area want you to succeed. The sense of community is just different. And the cost of living allows us to have a facility that would be much harder to get in New York City!”

The Community Loan Fund offers a variety of lending options and continued support for non traditional businesses like Dance Fire Studio & Fitness. Many traditional banks would call this a high risk, and it would be highly unlikely that the loan would be approved. The Community Loan Fund offers reviews on a case-by-case basis for its financial viability and positive social impact. If you are looking to expand your business, you can get more information and set up a time to talk with someone at The Community Loan Fund by clicking here.

The Community Loan Fund has been helping businesses and individuals be successful since 1985 and offers a variety of programs and resources. Although there are other loans small business can get onboard with, such as those from smallbusinessloans.co, the Community Loan Fund provide access to capital for microenterprises and freelancers for business development. This article is a part of a series that highlights local businesses who has benefitted from a Community Loan Fund Loan, like The Makeup Curio, and have used it to build their business.

Jenn Dugan at The Makeup Curio started her business officially in August 2016 in her home, but when she wanted to expand her business to include facials, she knew she wanted to do it right- and that required her to not only have her aesthetics license but an actual space to run her business in.

Jenn Dugan at The Makeup Curio started her business officially in August 2016 in her home, but when she wanted to expand her business to include facials, she knew she wanted to do it right- and that required her to not only have her aesthetics license but an actual space to run her business in.

She opened the store in October 2017 with the help of a Community Loan Fund Loan.

“It was a gradual progression and took about 4 months from start to finish,” Jenn says.

When asked what advice she has for other creatives and aspiring aestheticians, Jenn says, “Be patient, it’s hard, but it will come when it’s meant to.”

Jenn began as a costume designer with an emphasis in theatre. Many in this job position also have to do makeup as well, so her first job involved both. She started out as a self-taught hair and makeup stylist, and she does not do “real hair” she styles wigs to be worn for costumes.

Jenn’s love for makeup began to develop and she transitioned to full-time makeup artistry about six years ago. Two years later, she began doing professional makeup regularly for special events, weddings, galas, and of course Halloween makeup. She has also been able to enjoy doing work in theater by teaming up with local high school theater programs to do makeup and hair. This way she is able to bridge the gap between makeup artistry and theatre, and still do what she loves.

She has morphed her business in to two parts – “the “Beautiful” and “the Unusual” – allowing her to do classic event or gala makeup but also to get creative with theatrical and Halloween makeup as well. Jenn says this allows her to be creative and she loves doing both.

There is a strong seasonality to her business. In summer, she helps with theater camps and does makeup appointments on the weekends for special events. In the fall, special events continue with the wedding season, and Halloween is another busy time of year.

October has been her busiest month recently. “People forget that wedding season goes through October,’ Jenn says. “There are days when I have a wedding in the morning, then head over to an event makeup appointment, and then have someone who wants Halloween costume makeup later that evening.” Whilst this is great for her business, it can make filing her taxes a little bit more difficult! With the extra business and income, there will be more to report when she files her taxes. Taxes can be difficult to file anyway, which is why some businesses get in contact with Dave Burton to help them out. In those busier months, it might be a good idea to get some extra help when filing taxes, just to check they’ve been done correctly.

Jenn’s ability to secure a loan from The Community Loan Fund has allowed her to run her business in a space that meets her needs and gives her room to hone her craft even further. When asked why she loves to run her business in the Capital Region, she says “There are so many creatives and collaboration is easy. People actually want others to succeed, and they are supportive of each other.” Others looking to launch a business of their own may want to look towards the services of atlantic union bank to secure a business loan that will set them on the path towards success.

The Community Loan Fund offers a variety of lending options for non-profits, small businesses, freelancers, entrepreneurs, and more. Let’s say you are a freelance photographer and you need $1,000 to cover the cost of upgrading your equipment. The Community Loan fund is more likely to approve a loan for this expense over a traditional bank. Many traditional banks would call this a high risk, and it would be highly unlikely that the loan would be approved. The Community Loan Fund offers reviews on a case-by-case basis for its financial viability and positive social impact. If you are looking to expand your business, you can get more information and set up a time to talk with someone at The Community Loan Fund by clicking here. If like Jenn you’re starting your own business or you already run you’re own, then I suggest taking a look at Salesforce who help shape businesses across all industries by providing information on digital technology and how its transformation will help with promoting your business.

The Community Loan Fund offers a variety of lending options for non-profits, small businesses, freelancers, entrepreneurs, and more. Let’s say you are a freelance photographer and you need $1,000 to cover the cost of upgrading your equipment. The Community Loan fund is more likely to approve a loan for this expense over a traditional bank. Many traditional banks would call this a high risk, and it would be highly unlikely that the loan would be approved. The Community Loan Fund offers reviews on a case-by-case basis for its financial viability and positive social impact. If you are looking to expand your business, you can get more information and set up a time to talk with someone at The Community Loan Fund by clicking here. If like Jenn you’re starting your own business or you already run you’re own, then I suggest taking a look at Salesforce who help shape businesses across all industries by providing information on digital technology and how its transformation will help with promoting your business.

Our December Creative Economy Mixer was at the regions hottest new maker’s space, the Electric City Barn in Schenectady. December’s event featured drinks by Frog Alley Brewing, music by Shiri Zorn and George Muscatello, and a panel discussion moderated by Kat Koppett, Founder of KOPPETT, and Kristin Diotte, Director of Planning, Zoning and Community Development for the City of Schenectady, focuing on the role of the Creative Economy in downtown and community development. Thanks to our sponsors MVP Health Care, Community Loan Fund, and Redburn Development: The Fitzgerald Building, and our promotional partners Mopco and Koppett, Discover Schenectady and Black Dimensions In Art, Inc. Produced in partnership with 2440 Design Studio and WMHT.

[cs_content][cs_section parallax=”false” style=”margin: 0px;padding: 45px 0px;”][cs_row inner_container=”true” marginless_columns=”false” style=”margin: 0px auto;padding: 0px;”][cs_column fade=”false” fade_animation=”in” fade_animation_offset=”45px” fade_duration=”750″ type=”1/1″ style=”padding: 0px;”][x_slider animation=”slide” slide_time=”3000″ slide_speed=”1000″ slideshow=”true” random=”false” control_nav=”false” prev_next_nav=”false” no_container=”false” ][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide][x_slide][x_slide][x_slide]

[/x_slide][x_slide][x_slide][x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][x_slide]

[/x_slide][x_slide] [/x_slide][/x_slider][x_gap size=”50px”][cs_text]ACE’s Creative Economy Mixer at LUMBERYARD in Catskill featured a panel discussion with five people who have been instrumental to the Catskill renaissance: Adrienne Willis, executive and artistic director of LUMBERYARD; Liam Singer, co-founder of cafe/gallery/performance space HiLo; Karl Heck of Greene County Department of Economic Development; and Vincent Seeley, Catskill Village President. The discussion will be led by Sam Margolius, executive producer at Branch VFX, who grew up in the village and left to start a career in NY and LA, and returned to find a thriving new creative economy.

[/x_slide][/x_slider][x_gap size=”50px”][cs_text]ACE’s Creative Economy Mixer at LUMBERYARD in Catskill featured a panel discussion with five people who have been instrumental to the Catskill renaissance: Adrienne Willis, executive and artistic director of LUMBERYARD; Liam Singer, co-founder of cafe/gallery/performance space HiLo; Karl Heck of Greene County Department of Economic Development; and Vincent Seeley, Catskill Village President. The discussion will be led by Sam Margolius, executive producer at Branch VFX, who grew up in the village and left to start a career in NY and LA, and returned to find a thriving new creative economy.

We toured LUMBERYARD’s creekside studio and facility, enjoyed food from QUESTAR III’s culinary arts program and new Atelier Restaurant and Bar, a beer from Crossroads Brewing, a cameo performance by artist Brian Dewan, and more!

Special thanks to our sponsors, Questar III, Community Loan Fund, MVP Health Care, and our promotional partners Greene County Chamber of Commerce, Atelier Restaurant and Bar, and The Rodney Shop. Produced in partnership with 2440 Design Studio. and WMHT.[/cs_text][/cs_column][/cs_row][/cs_section][/cs_content]

Creative Economy Updates and Other Good Stuff!